Effective asset management, maintenance and capital expenditures are essential for the sustainable service delivery that meets the needs and expectations of stakeholders. They are guided by the Asset Management Operations Manual, Federation University’s Finance Policies, Procedures & Guidelines and linked to achieve the University’s strategic objectives.

The purpose of the Asset Management - Operations Manual is support Federation University’s strategic objectives through the development and implementation of an Asset Management System (AMS) Framework. This Manual ensures that Federation University’s manages its facilities and assets in a sustainable way to meet its infrastructure needs for the delivery of quality services. This Manual has been specifically developed to satisfy applicable compliance requirements with the Asset Management Accountability Framework (AMAF); to achieve conformance with the ISO55001 Asset Management System Framework and is consistent with the University’s Strategic Plan.

The Manual governs the implementation of Asset Management Strategy, Asset Management Plans, lifecycle processes and strategies, management systems and procedures that address:

- The nature and purpose of the University;

- The University’s operating context and alignment with its goals and objectives;

- Financial constraints, regulatory and reporting requirements;

- Commitment to continuous improvement of the asset management system framework; and

- The needs and expectations of the University and its stakeholders.

It also prescribes the steps required by the University to ensure that the Asset Management activities are aligned with the strategic goals and objectives. This will ensure that asset management planning is undertaken in a coordinated way and expenditures are planned, evaluated, authorised, implemented, monitored and reported in a systematic manner to meet the strategic objectives. Other non-mandatory requirements may be further explained within local guidelines or standard operating procedures.

This Operations Manual mandates operational activities and assigns responsibilities to support the Asset Management activities.

This Manual is intended to define the key asset management principles and requirements to be applied to the facilities, infrastructure, and assets by the University to ensure that service delivery objectives and strategic outcomes are delivered.

The key objectives of this Manual are:

- to ensure that the university’s facilities, infrastructure, and assets are fully utilised;

- contribute to a commercially sustainable business;

- support the delivery of quality services of education, research, ancillary and investment activities; and

- continue to function at a level of service accepted by the stakeholders.

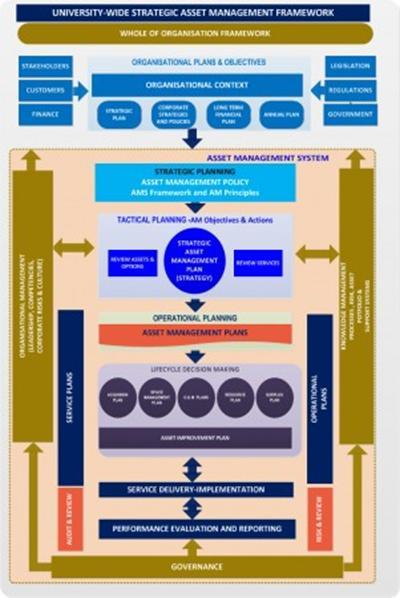

A key function of this Manual is to define the Asset Management System Framework that will guide Asset Management Lifecycle activities undertaken across the whole organisation in a structured, coordinated, cost effective, safe and environmentally sustainable manner to achieve the University’s-strategic goals and objectives (University’s AMS Framework is described in Figure 1).

The application of the AMS Framework will provide assurance in optimising and balancing the whole of life costs, asset performance and risks associated with managing facilities and assets, so that the objectives can be achieved consistently and in a sustainable, well planned, and coordinated manner while minimising the University’s exposure to risks.

This will be achieved through the development, implementation and continuous improvement of the Strategic Asset Management Plan (Strategy) and Asset Management Plans for the University.

Figure 1 – University Asset Management System Framework

This Manual is applicable to all University and its subsidiaries’ lifecycle asset management activities or functions and all University and Subsidiaries-owned or operated assets to achieve the organisational objectives including:

- Capital Fixed Assets e.g. Buildings, Artwork, Library Collections, Plant and Equipment etc.

- Current Assets (Inventory/Stock) e.g. Cash, raw materials etc.

- Tangible Assets (Attractive Items) e.g. iPads, Laptops, mobile phones etc.

- Intangible Assets e.g. Digital Library collections, Copyrights, Brands etc.

- Operating Assets e.g. Investment Property (Tech Park assets), Motor Vehicles etc.

- Non-Operating Assets e.g. Vacant Land, Securities, Interests etc.

This Manual applies to all University and its Subsidiaries’ officers involved in the creation, operations and maintenance, upgrade/renewal and rationalisation of assets. The Manual applies to all contracts applicable in these areas. It also applies to all officers responsible for the delivery of services that make use of University assets, including University employees, contractors and appointees and any other person acting for or on behalf of the University.

The scope of the Manual is also guided by DTF’s Asset Management Accountability Framework (AMAF) and ISO55001: Asset Management System.

An asset is defined as a resource owned or controlled by the University which is expected to bring future economic benefits to the University and has a cost or value that can be measured reliably.

This Manual applies to all University and any Subsidiaries activity and all University and Subsidiaries-owned or operated assets including IT systems and software; all items of a physical or tangible nature including attractive and portable items; inventory; cultural and/or scientific collections; and library collections. This Manual will apply to all staff members of the University and its Subsidiaries.

There may be Asset Exclusions from this Manual where the local financial legislation conflicts with the remit of Federation University Australia Act 2010. Such exclusions must be reported to the COO and CFO.

The University is required to manage its asset management procedure documentation within a legislative framework. The University functions and obligations are primarily set out by the following regulatory and other guidance requirements:

- Federation University Australia Act 2010 and Amendments;

- Education and Training Reform Act 2006 (ETRA-TAFE Victoria);

- Financial Management Act 1994 (Standing Directions of the Minister for Finance);

- Public Administration Act 2004;

- Freedom of Information Act 1982;

- Building Act 1993 and Building Code of Australia;

- Land Acquisition and Compensation Act 1986 (Vic)

- Victorian Government Land Transactions Policy and Guidelines

- Victorian Government Strategic Crown Land Assessment Policy

- Victorian Government Landholding Policy and Guidelines

- Victorian Government Land Use Policy and Guidelines

- Education for Overseas Students Act 2000;

- Higher Education Support Act 2003;

- Tertiary Education Quality & Standards Agency Act 2011;

- Occupational Health & Safety Act 2004 & Regulations;

- Audit Act 1994;

- Victorian Legislation and Parliamentary Documents;

- Environmental Protection Act 2017 and subordinate legislation.

Local Financial Legislation may apply to Assets held by the University outside Victoria.

This operating environment requires Federation University to establish and implement strategic plans, policies, strategies and asset management plans for managing its assets.

For the purpose of this Manual, unless otherwise stated, the following definitions shall apply:

| Term | Definition |

| Accountability | The attribution of responsibility for asset management activities. |

| Accountable Officer | Chief Financial Officer. |

| Artworks | These include paintings, sculptures and tapestries. |

| Asset | An item or thing that has potential value to the University, and for which the University has a responsibility (e.g. building, plant etc.). For the purposes of the Asset Management System Framework, asset does not include financial assets. |

| Asset Management Information System (AMIS) | A system, combining software components, to collect, hold and analyse asset & performance data. |

| Asset Management |

The coordinated activities of the University to realise lifecycle value from assets in delivery of its objectives. Realisation of value will normally balance costs, risks, opportunities and performance benefits. When asset outputs or required service levels are pre- determined and non-negotiable, or when value is negative (e.g. dominated by risks or liabilities), ‘to realise lifecycle value’ may represent minimising the combination of costs and risks. |

| Asset Register | A record of asset information, including asset attribute data (such as quantity, type, cost). A University wide register held within the Finance Directorate showing the assets that are owned. It consists of clearly stated costs of assets both direct and incidental, the date of purchase, serial number, internal reference number, and depreciation rate and method. Institutes/Directorates maintain their own Asset Register for operational purposes to capture detailed data of assets and their sub-components, not generally captured under the Financial Asset Register, which come under the responsibility of the respective Institutes/Directorates. |

| Attractive Items Register | Attractive items mean any tangible item, which has a value of less than AUD $5,000 and does do not fall within the consumable category or is not a component part of a larger asset. This is a local register held within each Institute/Directorate recording the receipt, movement and disposal of non-consumable items of a portable and attractive nature. |

| Audio-Visual Equipment | This includes sound systems, televisions, display screens, AV Codecs, AV Control systems and projectors. |

| Buildings and Infrastructure | All buildings (owned and leased by the University or held on trust) and inclusions such as building fabric, mechanical, electrical and hydraulic services, car parks, roads and underground services |

| Capital Fixed Asset (also known as a non-current asset) |

Capital Fixed Asset means any tangible item aligning with definition of asset according to Australian Accounting Standards Board (AASB) 116 – Property, Plant & Equipment.

(This definition excludes intangible assets). |

| Consumable Items | Items with a life expectancy of one year or less are considered to be consumable items. E.g.: stationery, cleaning supplies. |

| Cost Model | Initial cost less accumulated depreciation and any accumulated impairment losses. |

| Cyclical Stocktake | Where only part of the stock is counted at any one time, but these counts are carried out on a regular, scheduled basis e.g. : weekly, monthly. |

| Depreciation | A reduction in the value of an asset that occurs over time as the asset gets older or as wear and tear occurs. |

| Fair Value | The amount for which an asset could be exchanged or liability settled, between knowledgeable, willing parties in an arm’s length transaction. Where there is no market-based evidence of fair value (because of the specialised nature of the asset), depreciated replacement cost may be used. |

| Initial Cost |

Includes the asset’s creation/acquisition/purchase price plus any costs directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended. Directly attributable costs could include, but are not limited to, site preparation costs, initial delivery and handling costs, installation and assembly costs, asset testing costs, and professional fees. Initial cost does not include costs of advertising, conducting business and administration (e.g. staff training), other general overheads, or cost of relocating/reorganising. |

| Intangible Assets |

Intangible assets are non-physical assets, owned or acquired by the University, that assist in the delivery of the University’s business activities and services. Intangible assets include trademarks, copyrights, computer software (purchased or internally developed) and intellectual property. For intangible assets only major items over the value of $100,000 will be considered for capitalisation. |

| Inventory - Stock |

Everything used to make products, provide services and to run part of the University's business is part of the University's stock. There are 4 main types of stock:

|

| Investment Property | Operating assets as classified according to AASB 140 Investment Property. |

| ITS Equipment | This includes networking equipment, peripheral devices, PCs and printers. |

| Land and Improvements | All land acquired (freehold), donated and held on trust (Crown Land / on behalf of the Minister). These fall under the Capital Fixed Asset Category. |

| Leasehold Improvements | Leased items or property. These fall under Capital Fixed Asset Category. |

| Library Collection | This comprises general book collection, rare books, manuscripts, DVDs and other recorded media. |

| Motor Vehicles | These include cars, utility vehicles, buses, grounds vehicles, boats, fleet and security vehicles. These fall under the classification of Operating Assets. |

| Non-Operating Assets | These assets are those which are not required in the conduct of the daily affairs of the business. They do not play any role in revenue generation (vacant land). |

| Operating Assets | Assets that are used in the conduct of day-to-day operations of a business and they help to generate revenue (such as Investment property – Tech Park, Motor Vehicles). |

| Printing Equipment | This includes printing machinery and photocopiers. These fall under Capital Fixed Asset Category. |

| Recoverable Amount | The higher of an asset’s fair value, less costs to sell and its value in use. |

| Replacement Value | The cost of replacing or rebuilding an asset to its initial standard. |

| Revaluation Model | Where the fair value of an asset can be reliably measured, the asset may be carried at a revalued amount, being its fair value at the date of revaluation, less any subsequent accumulated depreciation and subsequent impairment losses. Revaluations shall be made with sufficient regularity to ensure that the carrying amount does not differ materially from that which would be determined using fair value at the balance sheet date. All revaluations must be performed by an independent valuer; or where the University has on its staff a person sufficiently experienced to conduct a valuation, by that person, so long as the valuation has been subject to review by an independent valuer. |

| Right Of Use Assets | Leased assets capitalised according to AASB 16. These fall under the Capital Fixed Assets category. |

| Science Equipment | This includes all science and laboratory equipment. |

| Spot Check | Where, in a particular area, stock is checked for discrepancies. |

| Stocktake | A count and check of goods on hand ready for sale or use or in storage. |

| Tangible Assets -Portable and Attractive items |

Items that do not meet the asset capitalisation threshold and, consequently are expensed in the year of acquisition. The following statements also help determine what a portable and attractive item is:

As the name suggests, these are items with an attractive nature, such as mobile phones, laptops, video camera, projectors, printers and software. |

| Useful Life | The period over which an asset is expected to be available for use by the University to provide required level of service. |

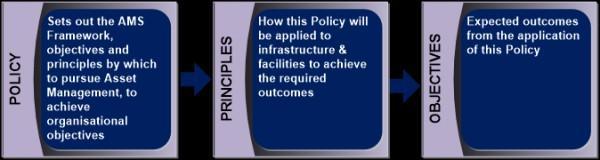

This Operations Manual is established on.

- A set of Operational Statements aligned to University’s strategic goals and objectives that reflect the overall asset management approach.

- A specific set of fundamental asset management principles

The AMS Framework, principles and objectives will drive asset planning and service delivery through the facilities and infrastructure assets.

The University will adopt the following Operational Statements to reflect the overall Asset Management approach:

- Apply a strategic approach to asset planning that supports the achievement of the University’s strategic objectives;

- Maintain an Asset Management System Framework that is aligned with the ISO55001 standard that will ensure safe, efficient and timely planning, condition and performance monitoring, operations and maintenance, creation, upgrade/renewal and appropriate disposal of an asset, as an integrated part of the University’s business;

- Ensure that adequate resources with necessary competencies are provided to manage lifecycle Asset Management activities/functions to achieve the agreed Asset Management objectives;

- Ensure alignment between all organisational functions that impact on Asset Management and engagement with stakeholders and customers to develop sustainable asset performance targets that optimise the use of financial and non-financial resources;

- Develop and implement Strategies, Asset Management Plans and associated asset delivery plans that enable the University to achieve its performance targets and organisational objectives;

- Optimise lifecycle asset decision making (acquisition, replacement, refurbishment and disposal) through consideration of costs, safety, asset performance and risks;

- Ensure that Lifecycle Asset Management decisions and functions/activities consider and balance the needs of all relevant stakeholders, both within and external to the University;

- The University will meet all regulatory and statutory requirements relevant to its assets and asset management functions;

- All Land Transactions undertaken by the University will adhere to the Victorian Land Transactions Policy and Guidelines and shall comply with the transaction approval process stipulated by the Victorian Government Land Monitor (VGLM).

- Ensure that Lifecycle Asset Management decisions and functions/activities comply with Government requirements and University policies relating to Occupational Health and Safety, Quality and the Environment;

- Ensure that University assets are managed in accordance with recognised asset management techniques that consider the achievement of both short-term and long-term business objectives;

- Ensure that the University’s Risk Management Framework and Criticality Framework are used to systematically identify, assess, prioritise and control risks to provide balance with asset performance and economic outcomes, when making decisions relating to the management of physical assets;

- Operate assets in a disciplined manner with precision;

- Maintain assets in such a manner that they continue to meet operational and service level requirements for the duration of their expected life;

- Establish a communication framework to create an asset management culture embedded in the University to facilitate regular audit and management reviews of the Asset Management System Framework;

- The University will have a culture of innovation and leadership to continually improve the efficiency and effectiveness of Asset Management processes, capabilities and performance to optimise the safety and quality of our assets.

This Manual is intended to give effect to the University’s Strategic vision, from an Asset Management perspective, which is:

“Transforming Lives and Enhancing Communities”

The Manual also supports the achievement of the University’s Strategic responses, which are:

- Building Australia’s leading community embedded university

- Offer Australia’s best multi-sector educational pathways and experience

- Understand and support learner diversity

- Become the partner of choice for regional employers and industry and government

- Grow the economic and cultural opportunities of the regions and communities we serve

- Create new ways of working together

To realise the University’s vision and to meet increasing service delivery demands requires a functional and cost- effective asset base. To achieve this, an integrated and multi-disciplinary approach to asset management is necessary with guiding asset management principles.

This Manual is based on a set of guiding asset management principles. All lifecycle asset management decisions will be guided by these principles.

The University will adopt the following fundamental principles (aligned with ISO55001 Asset Management Principles), to enable the creation and implementation of the asset management strategy, Asset Management objectives and relevant plans.

| Asset Management Principles | Description |

| 1. Aligned-Output Focus |

1. Asset management (AM) is an integral element of the University’s asset management system framework and has a direct link (alignment) with Strategic Plan and other Government Strategies/Policies, enabling plans, budgets and reporting requirements. 2. Assuring asset management planning aligns with stakeholder needs and expectations. 3. Undertaking asset management in a consistent manner, working to align our asset portfolio with service delivery in a truly integrated way (to ensure assets support the services provided). 4. Asset management planning considering all stages in the asset lifecycle (planning, creation-design & construction, operations, maintenance, renewal and disposal). 5. All asset management lifecycle functions are undertaken to optimise lifecycle costs, asset performance and risks. 6. Asset management decisions aim to achieve University Strategic objectives and quality service delivery outcomes. |

| 2.Organisational Capabilities |

7. The University will have a commitment to effective asset management (leadership, ownership, control, accountability and reporting), will promote cross functional integration of asset management processes from all levels to ensure achievement of organisational objectives. 8. All asset management activities are undertaken as part of the University’s overall resource allocation and management framework. Staff with lifecycle Asset Management functions responsibilities will have appropriate competence in relevant asset and financial management principles, practices, and processes. 9. Asset Management Information Systems (AMIS) will be maintained at levels that meet organisational and government information, decision making and reporting requirements. |

| 3. Compliance with Regulatory and Statutory Requirements |

10. The University will conduct internal and external audits and management reviews to determine the effectiveness of asset management practices and compliance against the AMAF and ISO55001. 11. The University will manage and maintain its facilities and infrastructure assets to ensure compliance with the relevant organisational plans/ policies, Government policies/strategies/standards, relevant regulatory and statutory requirements (e.g. AMAF, safety, environmental obligations). |

| 4. Continuous Improvement |

12. Asset management system framework performance and monitoring progress will be reported regularly to the Asset Management Committee, VCST and/or other stakeholders, in accordance with performance measures developed as part of the Asset Management Strategy and Plans and will be integrated with the Annual Reporting framework. 13. The Asset Management System Framework will provide a framework for the continual improvement of the asset management system. |

Through the application of this Manual, the University aims to achieve the following outcomes/objectives:

- Ensure resources and capabilities (competencies) are identified. The roles and responsibilities for asset management functions/activities are clearly allocated and articulated;

- Ensure that the asset portfolio meets service demands and requirements, which reflect stakeholder needs and expectations, with a focus on delivery of quality vocational education, higher education and research training services, to support the University’s strategic objectives;

- Support quality service delivery by providing the right assets at an appropriate time and location in appropriate amounts;

- Efficiently provide the services required by stakeholders by ensuring that assets are appropriately planned, built, acquired, operated, maintained and disposed of;

- Ensure ongoing financial sustainability by providing a clear and consistent direction for asset management, including maintaining the Asset Management Information Systems to an appropriate level;

- Provide easy access to up-to-date information on assets used for service delivery, including physical parameters and data on valuation, condition, function, performance and risk;

- Ensure compliance with regulatory and statutory requirements;

- Maximise value for money, by taking a lifecycle approach to the provision and management of facilities and infrastructure assets; incorporating asset lifecycle costing into all investment decisions;

- Establish and maintain an asset management system framework to enable the development and implementation of appropriate asset management practices and as a basis for continuous improvement.

This Manual covers the asset lifecycle consisting of:

- Asset Acquisition;

- Asset Deployment;

- Asset Operations and Maintenance; and

- Asset Retirement (Disposal).

Staff responsible for asset acquisition will ensure acquisition only occurs after a thorough risk analysis and financial planning. Such acquisitions will be recorded in an appropriate register for financial reporting, safe custody and insurance purposes.

The authority to purchase all assets is vested in nominated positions as outlined in the University's Delegations of Authority Guideline and such activities must comply with the University’s Procurement Framework.

All Land Transactions undertaken by the University within Victoria will adhere to the Victorian Land Transactions Policy and Guidelines and shall comply with the transaction approval process stipulated by the Victorian Government Land Monitor (VGLM). Assets managed by Federation University outside Victoria will need to adhere to the local financial legislation of that area.

The University:

- must not sell (grant a lease or an interest in) any land at a price which is less than the current market (or rental) value of the land as determined by Valuer-General (VG);

- must not purchase (acquire a lease or an interest in land) any land at a price which is greater than the current market (or rental) value of the land as determined by VG;

- must not sell any land without a public process (except through the first right of refusal process outlined in the Victorian Government Landholding Policy and Guidelines, or similar process outlined in other state financial legislations);

- prior to offering land for sale by a public process, must have in place the most appropriate zoning (and other relevant planning provisions) so that the land can be sold on the basis of its highest and best use;

- must not grant a lease of land (except to a government agency) which contains an option to purchase.

If an exemption is required from any of the above requirements, especially for strategic purposes, approval must be obtained from the University Council/VC respectively.

Assets can become the legal responsibility of the University via various means, including but not limited to:

- Purchase from all sources such as University budgets, Grants, donated funds, consultancy funds etc;

- Transfers, Gifts, donations or bequests;

- As Committee of management or responsible authority for Crown or Ministerial land/buildings;

- Construction or development internally by university staff, students or contractors; and

- Loans, leases hire agreements etc.

The following are required, regardless of acquisition method:

- The need for the new or replacement asset has been clearly articulated in an approvedbusiness case which identifies:

- How the purpose for which the asset is required is in keeping with the objectives of the University;

- How the asset will provide significant, direct and tangible benefit to the University;

- The necessity of the purchase and seek to identify or rule out other feasible alternatives e.g. another University asset that could be upgraded or adapted.

- The alignment of the asset with the University’s Masterplan and relevant Asset Development Plans.

- The asset is appropriate to the task or requirement and is cost effective over the life of the asset;

- The asset is compatible with existing equipment and will not result in unwarranted additional expenditure on other assets or resources;

- Space and other necessary facilities to accommodate the asset are in place;

- The most suitable and appropriate type, brand, and model etc. has been selected;

- The “whole of life cost” of the asset has been factored both into the business case and is also reflected in any Tender evaluation plan along with purchase cost and other assessable attributes;

- A plan and budget for the assets implementation, ongoing maintenance and eventual disposal has been developed and approved by the responsible officer;

- Assets purchased with researchfunds and endowment funds will remain the property of the University unless specific grant conditions state otherwise.

- Assets purchased below the asset recognition threshold are to be expensed and may be required to be recorded in an Attractive items register maintained by the relevant department/directorate.

- The asset can be stored & operated in a safe environment. To this end a hazard identification, riskassessment and controls assessment has been undertaken and residual risk has been mitigated;

- Where risk cannot be fully mitigated this risk has been documented and accepted by senior management of the University;

- Compliance with all relevant ministerial directions, University procedures and stakeholder requirements has been achieved where practical and exceptions (where they exist) have been documented and accepted by senior management;

- Vehicles will be purchased in accordance with the University Fleet management Policy and Procedure; and

- The asset must be recorded on the appropriate asset register, attractive items register, insurance register, risk register or inventory control system/register etc;

- Where assets are transferred within the University, the value of the asset remains unaltered but the transfer details will need to be captured in the responsible Department/Directorate’s Asset Register.

The above will also apply to significant items of maintenance expenditure where it is likely the expenditure could result in a new or significantly improved asset being created.

- 6.3.1 Risk Assessment

- 6.3.2 User Training

- 6.3.3 Post Implementation Review (PIR)

- 6.3.4 Portfolio/Institute or Directorate Asset Manager/Officer

- 6.3.5 Asset Manager/Officer Responsibilities

- 6.3.6 Safeguarding of Assets

- 6.3.7 Insurance

- 6.3.8 Asset Recognition and Measurement

- 6.3.9 Reconciliation to General Ledger

- 6.3.10 Method of Measurement (Valuations)

- 6.3.11 Depreciation of Assets

- 6.3.12 Impairment of Assets

- 6.3.13 Assets on Loan Outside University

- 6.3.14 Portable and Attractive Items

- 6.3.15 Inventory and Stock Control

Before new items of equipment are introduced into the workplace the purchaser will ensure the following:

- A riskassessment has been undertaken;

- Record the asset in the appropriate Register(s);

- Deliver end user training.

A risk assessment in alignment with the University’s Risk Framework, should be undertaken both prior to acquisition and deployment. This assessment is to be undertaken in consultation with affected stakeholders and end users in accordance with the following:

- Relevant Health, Safety and Security Management Policies and Procedures;

- Hazards Management Procedures and guidelines (e.g. HIRAC Procedure).

- Develop an appropriate training program to ensure the asset meets the needs of end users and they are competent in its use;

- Undertake end user acceptance training;

- Deliver end user training.

Significant asset acquisitions may require a PIR in accordance with the University Project Management Guidelines and the Benefit Realisation Review process of the Project Management Office (PMO). (refer to the Project Management Framework Procedure).

A responsible officer or staff position/s is to be nominated in each area (where necessary on a campus-by-campus basis) to have responsibility for managing the assets for that area, ensuring compliance with related procedures, performing stocktakes and being a local contact for the Head, Corporate Finance.

Asset managers/officers are responsible for ensuring:

- appropriate systems and procedures are in place to measure asset performance & condition and identify when asset retirement/replacement is required;

- assets are used for the purposes for which they were acquired;

- asset condition and performance meet expected standards, level of service and is regularly reviewed to identify under-utilised and under-performing assets;

- the reasons for underperformance are critically examined and appropriate rectification actions are taken;

- a plan exists for the ongoing maintenance of the asset and this plan is reviewed regularly;

- a plan is in place for the eventual replacement, refurbishment / disposal of the asset;

- the safeguarding of assets under their control;

- Advising of any asset transfers or movement;

- Biennial stocktakes;

- Updating of the UniversityAsset Register;

- Keep track of assets borrowed by staff for University Business purposes.

All staff are responsible for the security, care and protection of University assets. Every person who utilises the property of the University should do so with utmost care and consideration and in a manner which ensures the property will be subjected to the minimum wear and tear and safeguarded against theft and damage. University assets may only be removed from University premises with appropriate approval.

The safeguard of equipment, such as PCs, laptops, tablets, mobile phones and cameras, is particularly important not only because of their attractive and portable nature but also because of the confidential information that they may contain. Steps must be taken to limit the risk of loss or theft including:

- keeping offices locked when unattended and when travelling;

- not leaving items unattended in public places,particularly in motor vehicles;

- in the case of portable items, such as laptops, tablets and cameras etc., when travelling, by removing all confidential information not required for the trip from laptop bags or cases.

The University insures all assets subject to significant risk. However, all losses are subject to a deductible amount per claimed event. The excess amount is variable depending on the type of claim being made. A full Insurance schedule is available from the Finance Directorate. As a result, the University will only receive the insurance replacement value less the deductible amount.

Capitalisation Criteria

- An asset is classed as a fixed asset and required to be recorded on the University’s fixed asset register when it meets all of the following criteria:

- The GST-exclusive initial cost price of the asset exceeds the capitalisation threshold:

- Initial cost price is equal to or greater than $5,000 (GST exclusive);

- The asset is an individual work of art; or

- The intangible assets (such as major software items) or items over $100,000;and

- The asset has an estimated useful life greater than 1 year, and

- The asset has not been purchased with the intention of resale.

- The GST-exclusive initial cost price of the asset exceeds the capitalisation threshold:

- Expenditure may be capitalised if it is expenditure on an existing asset and the expenditure was incurred to improve the asset’s functionality, not merely to reinstate its future economic benefits (e.g. repairs and maintenance).

- Spare parts may be capitalised where they meet the capitalisation threshold and they are expected to be used over more than one year.

Recording of Assets in the Asset Register

The Finance Directorate must be advised of the details of any new asset $5,000 or more in value.

Individual Assets costing $5,000 or more and having a useful life of more than one year must be recorded in the Fixed Asset Register maintained within the Finance Directorate. These assets are depreciated over their useful life. Assets costing less than $5,000 are treated as 'non-capital' items and are expensed at the time of purchase but maybe included in the attractive and portable items register if they meet the criteria.

Individual Assets with a value of between $5,000 and $50,000 purchased with Research Grant Funds will be recorded on the Fixed Asset Register and fully depreciated on purchase. Individual assets with a value greater than $50,000 purchased with Research Grant funds will be depreciated over the life of the initial Research Project.

The account code used for all asset purchases will be provided by the Finance Accountant, who will verify these items and allocate them accordingly.

New assets purchased by way of an official University Purchase Order or payment made through the Accounts Payable system are automatically identified as part of the operational processing within the Finance Directorate. Assets received by way of donation, construction or purchased by University issued Corporate Cards with a value in excess of $5,000 must be the subject of advice from the nominated responsible officer within each Portfolio/ School or Section. An Asset Acquisition Form is available on the Finance Forms page.

General principles relating to the recording of assets are:

- Donated Assets - assets donated to the University with a value in excess of $5,000 or more must be entered into the Asset Register. Advice by way of a completed Asset Acquisition Form must be provided to the Head, Corporate Finance.

- Leased Assets - all leases must be approved by the Chief Operating Officer/Chief Financial Officer. All leases must be assessed under AASB 16 by Finance to determine if they are to appear on the Fixed Asset Register.

- Assets on Loan to University - Assets on loan to the University are not added to the Asset Register. They should be recorded on the local Portfolio/School and Directorate register and shown as 'On Loan to University'.

- Additions to existing assets - Upgrades or additions to existing assets over $5,000 in value and upgrades or additions that will take the original asset value over the $5,000 threshold by its inclusion must be added to the Asset Register. Advice by way of a completed Asset Acquisition Form must be provided to the Head, Corporate Finance.

- Constructed Assets - Assets which are constructed within the University are to be entered into the Asset Register when the value of that asset exceeds $5,000. Advice by way of a completed Asset Acquisition Form must be provided to the Head, Corporate Finance.

- Part Payment for Assets - Assets for which deposits etc, have been paid are not added to the Asset Register until full payment has been made and the asset is installed and ready for use.

Measurement

- Once it has been established that an asset meets the criteria for recognition, it is recorded on the University’s fixed asset register at cost price (or cash price equivalent if purchased using deferred payment and/or foreign currency). Donated items are recorded at their fair value.

- Assets can be measured as:

- Individual assets;or

- A collection of related items or components that cannot operate in isolation, whose combined original cost exceeds the threshold (refer to the capitalisation threshold); or

- An accessory which is required for permanent attachment to an existing capitalised asset. The cost of the accessory is to be added to the existing asset if it meets any of the capitalisation threshold.

A nominated Finance Officer is responsible for reconciling the Fixed Asset Register with the General Ledger asset accounts on a monthly basis. Any discrepancies arising are investigated and corrective action taken to bring the two records into balance.

Assets with tangible market value undergo regular valuation or re-valuation in accordance with Accounting Standards AASB116, during their remaining useful lives, to ensure that they reflect a true financial position. The cost model of measurement attributed to an asset must be applied across an entire class of assets and cannot differ among individual assets in a class.

Revaluations of classes of assets are conducted more frequently if, at balance date, the fair value of the asset differs materially from the carrying amount. Movements in the value of assets are transferred to the asset revaluation reserve for that class of assets.

A decrease in the value relating to a class of assets is recognised in the Statement of Financial Performance in the period it arises where it exceeds the increase previously recognised in the asset revaluation reserve. In subsequent periods, any revaluation surplus that reverses previous revaluation deficits is recognised as a credit to expenditure in the Statement of Financial Performance up to its original value.

The Head, Corporate Finance arranges for valuations, by an independent professional valuer, of land and buildings, investment property, artwork and precious objects. Any changes resulting from the periodic valuation are reflected in the Asset Register.

The approved methods of measurement by class of asset are:

| Asset Class | Mode of Measurement | Cycle |

| Land | Cost then Revaluation | 3-5 yearly |

| Building Structures | Cost then Revaluation | 3-5 yearly |

| Building Services | Cost then Revaluation | 3-5 yearly |

| Building Fit-out | Cost then Revaluation | 3-5 yearly |

| Works of art | Revaluation | 3-5 yearly |

| Infrastructure assets | Cost then Revaluation | 3-5 yearly |

| Leasehold improvements | Cost | n/a |

| Computer Systems & Equipment | Cost | n/a |

| IT Software | Cost | n/a |

| Furniture & Office Equipment | Cost | n/a |

| Library Collections | Cost | n/a |

| Musical equipment | Cost | n/a |

| Motor Vehicles | Cost | n/a |

| Plant, Machinery & Operating Equipment | Cost | n/a |

Depreciation is the accounting process used to allocate the cost to particular accounting periods of 'using up' the service potential of the asset over its estimated useful life. The University depreciates those assets deemed to be depreciable on a straight-line basis over the estimated useful life of the asset.

The depreciation methods and rates currently applied by the University are:

| Asset Class | Depreciation Method | Useful Life |

| Land | Not depreciated | indefinite |

| Building Structures | Straight line | Under advice from independent valuer |

| Building Services | Straight line | Under advice from independent valuer |

| Building Fitout | Straight line | Under advice from independent valuer |

| Infrastructure assets | Straight line | Under advice from independent valuer |

| Leasehold improvements | Straight line | Based on lease term |

| Computer Systems & Equipment | Straight line | 3-5 years |

| IT Software | Straight line | Estimated at time of purchase |

| Furniture & Office Equipment | Straight line | 3-15 years |

| Library Collections | Straight line | 8 years |

| Musical equipment | Straight line | 5-25 years |

| Motor Vehicles | Straight line | 5 -10 years |

| Plant, Machinery & Operating Equipment | Straight line | 4-15 years |

| Works of art | Not depreciated (due to heritage nature of the assets) |

Notes:

- Assets purchased under a ResearchGrantwill be depreciated over the initial term of the Research Contract;

- Land, works of art, precious objects and rare books forming part of the Library Collection and non-current assets classified as held for sale are not depreciated;

- Depreciation charges commence from date of purchase or completion of building works.

- An asset could be considered impaired where its carrying amount falls below its recoverable amount.

- Asset impairment may occur due to: significant technological, market, economic or legal changes, evidence of obsolescence or physical damage, significant decline in current market price or significant adverse change in expected use of the asset.

- The University reviews the carrying amounts of all property, plant and equipment on an annual basis. If any indicators of impairment are present, the University will make a formal estimate of the recoverable amount and the appropriate adjustments as required by the Accounting Standards

- Any impairment loss on a non-revalued asset shall be recognised immediately in the Statement of Financial Reporting Performance. Any impairment loss on a revalued asset is recognised directly against any revaluation reserve to the extent that the impairment loss does not exceed the amount in the revaluation reserve for that category of asset.

Loans to outside institutions and individuals - items lent to other organisations or individuals outside the University require adequate "all-risks" insurance to be taken out by the borrower and approval is required in accordance with Disposal of Assets under the Delegations of Authority Guideline. All expenses associated with the removal and returns are at the cost of the borrower.

In authorising a loan or hire, the authoriser is declaring that the asset is not required for University purposes for the duration of the loan or hire period, or that the use required by the University can be accommodated under the terms of the loan or hire. Assets are valuable and must not be hired unless appropriate safeguards are in place.

University purposes must always have priority over external uses. Assets must not be lent for private use by staff, students or the general public.

Loans likely to exceed six months must be recorded on the University Asset Register and therefore advice needs to be provided to the Head, Corporate Finance. Loans under six months need only be recorded within the area of responsibility. A local "Register of Assets on Loan" should be maintained by each Dean/ Director for such purposes. It is suggested that at a minimum the following details need to be recorded:

- date of loan;

- asset description;

- asset serial No.;

- asset No.;

- borrower's name;

- borrower’s signature;

- borrower's location;

- approving officer's name and signature;

- date of return; and

- acquitting officer's signature

A recommended spreadsheet format for an asset on loan register is available at the Finance Forms page.

Assets on loan are subject to periodic stocktake and their temporary return for this purpose may be required. Should a staff member holding an asset on loan leave the University then the relevant Dean or Director must ensure that the asset is returned prior to but not later than their last day of service.

Assets held off-campus - University assets may be installed/located off-campus if such location is justified and is approved by the relevant Senior/Deputy Vice-Chancellor, Vice Chancellor & President, Dean or Director. Persons removing items off campus and/or loaning items off campus are personally responsible for items under their control and are also liable for any loss or damage not recoverable from the University's insurers.

Recording of Tangible Assets - Portable and Attractive Items

Those assets deemed a “portable and attractive item” must appear on an Attractive Item Register. Items assessed as being high risk of theft or misappropriation, should be recorded e.g. portable and common use items such as tablets, mobile phones, cameras and printers, laptops and software. Each Institute or Directorate is to nominate a person within their area who will be responsible for the register.

Attractive Item Registers should contain sufficient information to enable positive identification of assets. It is suggested that at a minimum the following details need to be recorded:

- a unique asset ID No.;

- date of acquisition;

- cost;

- description;

- serial number;

- location;

- assigned custodian.

Although portable and attractive items are assigned to a custodian, the item remains the property of the University at all times. The register must be updated whenever a portable and attractive item is acquired, transferred to another user or disposed of. The Head of School or Director is to ensure adequate controls are in place to safeguard portable and attractive Assets from theft, loss and damage.

Items on the portable and attractive register are to be disposed of in accordance with Section 6.5 Retirement of Assets in this document with the exception of the following:

- The Asset Disposal Form must be approved by the Executive Dean of Institute or Director of Directorate and filed within the Institute or Directorate responsible and retained for audit purposes

- As these Assets are fully expensed when acquired, no further accounting entries are required.

Stocktaking

The physical counting of all stock that exists at a particular time allows us to compare figures to the stock records for the period of time covered by the stocktake. Conducting a stocktake allows accurate recording of what is actually on hand at each campus. There are 3 main ways that stocktakes are undertaken: a full and cyclical stocktake and a spot check.

The Head, Corporate Finance will coordinate stocktakes and provide appropriate documentation and support to facilitate a successful outcome. Such stocktakes will be subject to subsequent sample checking by delegated officers of the Head, Corporate Finance.

A stocktake of fixed assets appearing on the University Asset Register (cost $5,000 and over) are to be undertaken on a biennial basis. This will be coordinated by the Head, Corporate Finance.

A stocktake of portable and attractive items (value below $5,000) appearing on a local Attractive Items Register, shall be conducted on an annual basis by the nominated responsible officer within the Institute/Portfolio or Section. It is the responsibility of each operational area along with the assistance of the Head, Corporate Finance to conduct, and maintain records of the check for audit purposes.

Inventory and stock control for FedUni Living areas will be conducted on a monthly basis. This will be undertaken as Physical Stock on hand controlled through a POS system.

Preparation & Conducting of Physical Stocktakes

Planning

This step is the most important procedure in conducting a successful stocktake count. Planning involves establishing priorities, assigning responsibilities, problem solving, determining the inventory method and coordinating all activities. The inventory date and time is also determined and communicated to all involved.

Planning should include allocation of areas to be counted to individuals or teams of stock counters in order that a systematic approach is taken to ensure a full count.

Care should be taken to ensure that all stock to be counted is identified prior to the commencement of the physical count. This may include:

- Cleaning up the store area to ensure redundant stock and damaged stock returned to the store is disposed of and taken out of the inventory system.

- Ensuring that the receiving area is isolated from the store area and that any goods received prior to the count is identified and excluded from the count.

- Identifying all locations in which stock is located and assign these areas to counting teams.

Control

Responsibility for the control of the physical stocktake count rests with the Dean or Director of each area. A finance nominated responsible officer will oversee the process to ensure that planning is carried out and that stock counters are aware of Procedures.

The nominated responsible officer will be responsible for co-ordination and completion of the physical inventory. All issues should be directed to the Head, Corporate Finance for resolution.

Before a physical stocktake commences, the nominated responsible officer will be issued with written instructions of stocktaking count procedures. They will also be given verbal instruction to reinforce the instructions and ensure that they know what is required including follow up procedures for resolving variances.

Instructions

Detailed stocktake instructions should be prepared and distributed by the nominated responsible officer to all involved in the count. These instructions will clearly define the roles and responsibilities of all involved in the count. A practice inventory counting session may be helpful to those who have not previously participated in a physical count.

Conduct of the Inventory Count

The Executive Dean or Director will secure staff to participate in the stock take count. This person will coordinate with the Head, Corporate Finance to ensure Finance Directorate staff are available to supervise the physical inventory and the follow up of variances.

On the day before the physical stocktake count, all stock will be checked to ensure that goods received are recorded in the relevant areas.

On the morning of the physical inventory the receiving area will be quarantined to ensure that any stock received is excluded from the count.

Staff conducting the physical stocktake will:

- be assigned areas to the count;

- be issued with stock count sheets by the nominated responsible officer.

- Count stock within the areas assigned. If the manual method of stocktake is used, care should be taken to correctly identify stock, carefully count and record stock ensuring that the quantities recorded is in the correct unit of measurement, e.g.: sheets, cartons, reams etc;

- Staff conducting the stocktake should sign the stocktake count sheets;

- Finance Directorate will supervise the count, to help verify that quantities recorded are correct;

- Mark stock once it has been counted to ensure it is only counted once;

- Investigate discrepancies as directed by the Dean/Director and recount stock as requested; and

- Ensure that all items within the assigned area are included in the count. If a person counting believes stock is damaged or obsolete, bring this to the attention of the Dean/Director to determine if it is to be included in the count.

The responsible officer will ensure that:

- Staff conducting the count are properly instructed in procedures;

- Quantities recorded are in the correct units;

- Variances are investigated;

- Independent observers and supervisors have adequate opportunity to participate in, supervise and conduct test checks on the physical inventory;

- Any proposed adjustments to stock are approved by the Dean/Director and other relevant delegate from the Finance Directorate; and

- All steps of the stocktake process, including counts, investigations of variances, valuations and write offs are adequately documented.

Observation Tools and Supplies

If the manual method of stocktake is used; the nominated responsible officer will print stocktake count sheets; issue measuring instruments, clipboards, pens, and other items necessary to conduct the count. They will also determine how the stock or inventory will be listed i.e. by department using a standard spreadsheet, software package, alphabetical, by part name etc.

The Dean or Director or nominated responsible officer will ensure that prior to the commencement of the count all necessary preparation for the production of variances reports has been finalised.

Operations

The nominated responsible officer will:

- arrange for operations to be preferably halted or at least conducted at a minimal level to reduce the movement of stock and inventory;

- Prepare a log to document all movements of materials during the counting.

The Dean, Director or nominated responsible officer will ensure that the receiving area is isolated during the period of the count. It is also essential that all deliveries from stocktake place the day prior to counting to ensure that only essential deliveries take place on the day of the count. All such deliveries should be documented and care taken to ensure that they are correctly recorded for the stocktake.

Organise and Clean

Organising materials in storerooms will assist in efficient counting. Like items should be grouped together and any excess storage locations noted. In the days leading up to the count the store should be cleaned, obsolete and damaged stock identified and items of stock which are to be included in the count identified.

Preliminary Stock Estimates

Prior to stocktake, estimate stock inventory levels in each area for comparison with the actual count in order to test the reasonableness of the count. This assists in exposing counting mistakes and avails counters the opportunity to take corrective action.

During the physical stocktake, the responsible officer should observe that all stock has been marked as counted and follow up with the count team if stock is not marked.

Once the count is completed, all stock numbers will be compared to the perpetual inventory from the relevant system. Variances will then be investigated by the re-counting of stock on the ground, and the verification of the records of receipts and deliveries to ensure that no counting or cutoff errors have occurred.

Obsolete Stock

Identify obsolete stock and make arrangements to dispose of or exclude it from the physical count. Goods that are to be excluded should be clearly marked and preferably located away from other stock or inventory.

Administrative Office Supplies and Equipment

Office supplies not used in production or not held for resale such as pencils, paper, boxes of tissues, disks, etc, expensed when purchased and excluded from any physical stocktake count.

Identify Potential Problem Areas

Stock might provide counting problems (an example might be stock stored on shelves above head level, heavy or hazardous material). Resolve these problems by planning ahead how to handle them and ensure that participants are familiar with the inventory to be counted.

Adequate Supervision

All counting activities are to be adequately supervised. The responsible officer should evaluate the progress of the count. Any adjustments made in the prearranged procedures should be documented. To ensure the accuracy and validity of the physical count, an independent third party other than the nominated responsible officer for the inventory, e.g. personnel from the Finance Directorate area should be involved to oversee the count and perform sample checks.

Audit Function

Spot comparisons are to be made by the responsible officer of the completed stock count sheet with the stock on hand. Errors are to be corrected and evaluated as a basis for possible expanded sampling. If a master inventory listing is available, the count sheet information should be compared to this record. Any discrepancies should be investigated and resolved.

Final Check

A final check by the responsible officer should be made before the release of an area to ensure that all stock, inventory has been included in the count and the area is safe to continue normal business.

Update Inventory

After all stock has been counted and discrepancies checked, two copies of a variance report will be copied by the independent party from the Finance Directorate overseeing the count. At this point, on the nominated responsible officer's authorisation, the stocktake will be closed and records updated to reflect the levels of the count.

The second report is to compare with the pre-stocktake, inventory valuation. The difference should match the total variance report.

Variance

A copy of the variance report and stock valuation report with “Stocktake Check List” attached is then forwarded to the Head, Corporate Finance by the responsible officer for perusal and comment.

He/she may accept the adjustments or reject the stocktake or part thereof and appoint an independent person to enquire into the deficiency or result.

Evaluate Count Procedures

The Head, Corporate Finance will evaluate the count procedures applied and determine how these procedures may be modified to improve the next count. The best time to make adjustments to the following year's inventory instructions is immediately after the current year’s count is completed.

The University will ensure complete and compliant maintenance of assets in accordance with asset maintenance manuals or schedules, and statutory or regulatory requirements.

- Asset Maintenance will occur in accordance with the following principles:

- All plant and equipment should be maintained in good working order by care and servicing as recommended in manufacturer's manuals;

- The most efficient repair and maintenance strategy needs to be established and adopted;

- An operation and maintenance plan establishing responsibility and standards for the level of use, condition, servicing and performance should be developed;

- Supplier Maintenance Contracts should be obtained where considered to provide the most economic servicing and repair;

- A record of such contracts should be maintained to avoid needless expenditure on non-contracted repairers;

- Accurate recording of all warranties.

The authority to undertake asset maintenance work rests with Property and Infrastructure.

Property and Infrastructure will issue this authority via an official work order before maintenance works are undertaken. The only exception to the above rule is for specialist equipment that is the responsibility of institutes. Authorisation of maintenance expenditure will be in accordance with the University Delegations of Authority Guideline.

All contractors attending site to undertake maintenance related activity are required to:

- Be suitably qualified and insured in accordance with the University’s requirements;

- Hold a valid Working with Children Check or be actively supervised by someone who holds a valid WWCC;

- Have undertaken a site induction within the past 12 months;

- Sign in according to Property and Infrastructure procedures and make their presence known to the Property and Infrastructure Manager or representative;

- Sign out at the completion of the maintenance activity and provide an update as to the status of the work order they have been issued.

Asset maintenance is funded in accordance with asset management plans and will be prioritised according to risk factors to fall within the allocated resources available.

Certain types of maintenance such as statutory maintenance or emergency maintenance required to address an identified high risk will be carried out according to risk and legal requirements.

High Risk Issues

Where an identified high risk emerges it will be dealt with immediately via a combination of removal from service and remedial works.

Assets that present a high risk to users will be locked out or isolated until such time as the risks can be resolved or mitigated (refer to the University’s lock out tag out procedure).

The University will identify contingency plans for maintenance of assets after natural disasters or critical incidents.

Such plans will be undertaken in accordance with the following:

- the critical incident response and recovery process;

- local disaster recovery and continuity plans;

- VCST directives; and

- the ministerial directions for public construction requirements for dealing with a critical incident and associated reporting requirements.

- 6.5.1 Authority to Trade-in, Sell, Dispose or Destroy Assets

- 6.5.2 Tender

- 6.5.3 Private Sale

- 6.5.4 Donation

- 6.5.5 Destruction

- 6.5.6 Transfers within the University

- 6.5.7 Transfers to Other Organisations

- 6.5.8 Theft and Loss of Assets

- 6.5.9 Authority to Write-off Plant and Equipment Losses, Thefts or Destruction

- 6.5.10 Proceeds on Sale of Assets

All assets under the University's control must be disposed of in accordance with University procedures and financial delegations.

Reasons for Disposal include:

- surplus to requirements (current and future);

- part of an asset replacement program;

- unserviceable or beyond economical repair; and

- technologically obsolete and operationally inefficient.

The method of disposal will require a risk analysis, to ensure recipients are not exposed to unacceptable risk. Examples include “not fit for purpose”, contaminants or electrical hazards.

The authority to trade-in assets, destroy or otherwise dispose of assets is outlined in the Delegations of Authority Guideline.

All such disposals, except for the categories listed below, are subject to written advice from operational areas and are to be coordinated by the Head, Corporate Finance. An Asset Disposal Form is available at the Finance Forms page.

The following exceptions apply to the above directive:

- Motor Vehicles: All business use motor vehicle disposal is coordinated by Property and Infrastructure through Smartfleet, the University's nominated fleet manager;

- ITS Equipment: The ITS Directorate coordinates the disposal of all University non-leased IT assets.

- Land: All Land Transactions undertaken by the University is governed by the Federation University Act 2010 and the Financial Management Act 1994. Land transactions within Victoria will adhere to the Victorian Land Transactions Policy and Guidelines and shall comply with the transaction approval process stipulated by the Victorian Government Land Monitor (VGLM). Refer to Section 5.2 Acquisition for further guidelines. Transactions of land held by the University outside Victoria is subject to the local Financial Legislation of that area.

- All other Plant and Equipment will be subject to whichever of the following below methods offers the best return to the University:

- Tender;

- Private Sale;

- Donation;

- Destruction & removal; or

- Transfer.

- Disposal is to be coordinated by the individual area through Property and Infrastructure

Where the calling of tenders is the desired method of disposal, the University's Procurement Framework must be strictly observed.

This method is only acceptable in a limited number of circumstances e.g.

- there is only one apparent customer;

- there is an established market price for the asset;

- the cost by sale by another means would likely exceed the anticipated proceeds;or

- a sale to an educational or charitable organisation is contemplated.

Donations to Institutions with similar aims to the University, not-for-profit organisations, charities or community organisations should only be considered where no sales market exists or where the costs of alternate methods of disposal exceed the expected proceeds. All donations are required to be pre-approved by the Vice-Chancellor & President.

The responsible officer coordinating the donation of the asset must ensure a receipt is obtained from the recipient specifying the date of transfer of ownership of the asset and also update the Asset Register.

Disposal by this method should only be used when all other methods have been explored. All arrangements for destruction must be carried out under the supervision of the Head, Corporate Finance and be performed by Property and Infrastructure.

The responsible officer must arrange for the item to be disposed of in an environmentally responsible way and update the Asset Register.

Often particular assets considered obsolete or surplus to requirements in a particular operational area may be of value and use to another operational area. Where it appears that this may be the case, advice should be provided to the Finance Directorate and individual areas will arrange an internal University advertisement via Fed News seeking expressions of interest.

Applies when assets purchased via external research funding and that research project and funding is subsequently transferred to another institution or organisation. In these circumstances, the following conditions apply before the assets may be transferred:

- the particular grant or contract must contain a condition that the asset is not the property of the University; and

- the asset must have been purchased from external research funds and agreement must be reached between the University and the other institution or organisation for the transfer of these assets.

- The Vice-Chancellor & President, Chief Operating Officer, Chief Financial Officer or, Head, Corporate Finance, are delegated to commit the University in such negotiations.

Theft, loss or malicious damage of university assets should be immediately reported to Security who will undertake the applicable reporting requirements. The matter should also be reported to the Executive Dean of the Institute/Director of the Directorate along with the Head, Corporate Finance and the Insurance Officer. The Dean or Director is to prepare a written report for submission to the Chief Operating Officer and Chief Financial Officer seeking approval for either write-off action and/or for submission with subsequent insurance claims.

Also refer to Section 6.3.15 (Variance) for other relevant procedures in this regard.

The delegated authority to approve write-offs in respect of plant or equipment losses, thefts or destruction, that all reasonable recovery action has been taken, is outlined in the Delegations of Authority Guideline. For the purposes of the Delegations of Authority Guideline, the monetary limit relates to the original purchase price of the plant or equipment.

All exercises of this Delegations of Authority Guideline are to be reported to the Chief Operating Officer/Chief Financial Officer.

- Delegations of Authority Guideline

- Finance Governance Procedural Manual - Procurement of Goods & Services, Corporate Purchasing Card, Travel, and Motor Vehicles

- ITS Asset Disposal Process

- Asset Register (Finance Only)

Asset management requires a whole-of-organisation coordinated approach. Asset Management is the responsibility of and requires the active participation of University’s leadership and management teams.

A cross-functional Asset Management Committee will be established to oversee, coordinate, advise and facilitate the implementation of the Asset Management System Framework. The Asset Management Committee will report on the status of relevant asset management issues, practice, and strategy to the VCST on a quarterly basis.

- The specific roles and responsibilities (Responsible, Accountable, Consulted and Informed-RACI Matrix) will be detailed in the Asset Management Strategy

- Chief Operating Officer as the Approval Authority is responsible for monitoring the implementation, outcomes and scheduled review of this Manual

- Associate Director, Projects and Asset Services is responsible for the development, compliance, monitoring and review of this Manual.

- The Head, Corporate Finance is responsible for putting in place systems and procedures to correctly account for the fixed assets of the University and maintaining the University Asset Register.

- Responsibility for the control and safe custody of portable and attractive item remains with the Portfolio/Institute or Directorate who makes the purchase decision/acquires the item.

- The Head, Corporate Finance will ensure that each Institute/Directorate maintain a register of Attractive Items to record and receipt movement and disposal of non-consumable items of a portable and attractive nature. This register will be subject to an annual stocktake.

- Stock and Inventory control relating to business operations such as Campus Life will be coordinated by the Associate Director, Commercial Services and Technology Parks and the Head, Corporate Finance.

- All University staff who are involved in the purchasing, disposal, using, keeping, allocation and/or management of portable and attractive items are responsible for maintaining an up-to-date knowledge of this Manual, to ensure the University can comply with legislative obligations regarding the holding and disposal of university property.

Strategic Asset Management will be undertaken to ensure responsible custodianship and efficient use of the University’s assets. This will include the development and ongoing maintenance of the following:

- Strategic Asset Management Plan (Asset Management Strategy) – to be developed in accordance with the University’s Strategic plan and priorities. Further this document will be developed in align with the industry best practice guidelines (AMAF/ISO55001);

- Asset Management Plans – these are operational level plans to be developed in accordance with the University’s Strategic Asset Management Plan. Further this document will be developed in align with the industry best practice guidelines (AMAF/ISO55001);

Asset and Inventory Management OPERATIONS MANUAL

- Campus Specific Masterplans and Asset Development Plans – these are related to Universityproperty and infrastructure, to be developed and maintained for each of the major sites / campus locations;

- Regular Asset Condition and Functionality Audits - including a risk analysis of asset condition to be undertaken approximately every five years or as necessary to ensure adequate management and identification of risk;

Annual maintenance planning and budgeting;

- Appropriate training of staff and senior management who are responsible for Asset Management;

- Asset Management RACI chart - to be developed outlining Governance and Responsible officer for all Asset Lifecycle Functions within each Directorate.

- Asset Management Systems and processes to capture asset utilisation, usage, condition, records of maintenance and maintenance plans and lifecycle planning;

- Ongoing review and Continuous improvement of the above.

The Asset Management - Operations Manual will be communicated throughout the University via:

- A FedNews announcement and on the ‘Recently Approved Documents’ page on the University’s Policy Central website.

- Staff induction sessions.

- Information/Training Sessions; and/or

- Inclusion in the University's online Policy Library;

- Distribution of e-mails to relevant University Staff and Stakeholder.

The Associate Director – Projects & Asset Services and Head, Corporate Finance (under the Chief Operating Officer and Chief Financial Officer) is responsible for the development, compliance, monitoring and review of this Manual. They are also responsible for establishing systems and procedures to ensure compliance with applicable accounting standards and the stewardship of expendable items not captured within the accounting definition of an asset (e.g. portable and attractive items).

The Chief Operating Officer and Chief Financial Officer is responsible for the strategic and operational implementation of this Manual including:

- Physical and IT related assets;

- Retail and Commercial Services activities, stock and inventory; and

- ensuring Institutes & Departments are aware of their responsibilities as they relate to specialised equipment and resources held for teaching, research and consultancy activity.

All University staff who are involved in the purchasing, disposal, use, keeping, allocation and/or management of Portable and Attractive items are responsible for maintaining current knowledge of this Manual, to ensure the University can comply with legislative obligations regarding the acquisition, holding and disposal of University property.

Although Portable and Attractive items may be assigned to a custodian, the item remains the property of the University at all times.

This Manual provides the AMS framework for the on-going review and enhancement of asset management practices. This Manual shall be reviewed and updated at least every four (4) years to ensure consistency with the Strategic Plan, Government policies and enhance the effectiveness of delivering the necessary outcomes. The level or maturity status of asset management will be assessed in accordance with the industry best practice guidelines established to evaluate AMAF/ISO 55001 Asset Management proficiency, considering affordability and criticality criteria.

Regular audits will be undertaken to monitor compliance with the Manual with the strategic direction of the University, regulatory obligations and plans. Systematic and cyclic reviews will be applied to all facilities and asset classes to ensure that performance outcomes defined within approved assets performance parameters meet the required levels of service.

| Document title | Location | Responsible officer | Minimum retention period |

| Asset Disposal Form | Finance | Chief Finance Officer | 7 years |

| Portable & Attractive Item Register | Finance | Chief Finance Officer | 7 years |

| Inventory Control Register | Finance | Chief Finance Officer | 7 years |

| Asset Acquisition Form | Finance | Chief Finance Officer | 7 years |

| Register of Asset on Loan | Finance | Chief Finance Officer | 7 years |

Prev

Prev Up

Up Next

Next