Federation University University is actively committed to preventing fraud and corrupt conduct throughout the organisation as well as improving staff awareness of fraud and corruption risks.

This procedure sets out the Fraud and Corruption Control Systems to be followed in dealing with allegations of fraud and corrupt conduct and the elements that underpin the University’s fraud and corruption prevention, detection and response.

This Procedure applies across the University and its controlled entities, to all people who are part of the University community, including Council members, staff, students, consultants and contractors, honorary/visiting and adjunct fellows, research associates, volunteers and visitors. Each controlled entity can develop its own local procedure to address specific local requirements and to ensure compliance with local laws and regulations. The local procedure should still align with the broader University procedure. For purposes of this Procedure, all of the above categories will be referred to as “staff” below.

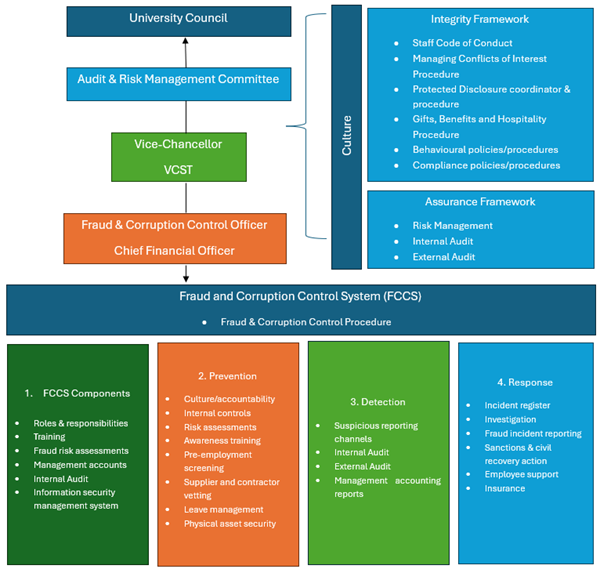

The University’s Fraud and Corruption Control System (FCCS) was developed to align with the core elements of the Australian Standard on Fraud and Corruption Control: AS 8001-2021.

Special procedures and protections apply to any person making a public interest disclosure under the Public Interest Disclosures Act 2012 (Vic). Disclosures under the Protected Disclosure Act 2012 are to be dealt with according to the University’s Protected Disclosures Procedure.

For the purposes of the Standing Directions (2018), this Fraud & Corruption Control Procedure acts as the University’s Fraud, Corruption and Other Losses prevention and management policy.

- AS/NZS ISO 31000:2009 Risk Management

- Australian Standard on Fraud and Corruption Control (AS8001:2021)

- Federation University Australia Act 2010

- Financial Management Act 1994

- Protected Disclosure Act 2012

- Public Records Act 1973

- Standing Directions of the Minister for Finance 2016

- Victorian Government Purchasing Board (VGPB) policies

- Victorian Government Risk Management Framework

The FCCS is an integral part of the University’s overall risk management plan on the premise that fraud and corruption are business risks that are controlled by the application of risk management principles.

The FCCS comprises a number of components, including:

- FCCS components - procedures and resourcing

- Prevention - initiatives to deter and minimise the opportunities for fraud.

- Detection - initiatives to detect fraud as soon as possible after it occurs.

- Response - initiatives to deal with detected or suspected fraud.

To minimise the risk of fraud and corruption, the University’s governance model incorporates:

- Clear lines of delegation with the Fraud and Corruption Control Officer central to responding to fraud and corruption claims;

- A strong culture, as supported by the integrity framework (built around the Staff Code of Conduct Policy) and assurance framework (independent attestation on the control effectiveness and management of risk); and

- Elements of the FCCS as detailed below.

The FCCS is a comprehensive framework for addressing fraud and corruption risks. It takes into account the University’s size, staffing, geographic footprint, risk profile and other factors such as industry risks, the economy and applicable laws and regulations.

Integral to the FCCS is clarity regarding roles and responsibilities, as detailed in the Policy. Other key foundations of the University’s FCCS include:

| Strategy | Description |

| Training: |

|

| Fraud and Corruption Risk Assessments: |

|

| Management Accounts: |

|

| Fraud and Corruption Incident Register: |

|

| Internal Audit: |

|

| Information Security Management System (ISMS) |

|

FCCS resourcing is a critical element of the University’s fraud and corruption control system. The University’s Council and the Vice-Chancellor’s Senior Team (VCST) are committed to ensuring that the elements of the FCCS are appropriately resourced to manage the assessed risks.

The FCCS will be reviewed every two years and amended as appropriately. Factors to be considered in reviewing the fraud and corruption control system include:

- Is it meeting its objectives.

- Significant changes in the University’s business conditions.

- Recently detected fraud or corruption control events.

- Results of any recent Fraud and Corruption Risk Assessment.

- Changes in fraud and corruption control better practices, locally or internationally.

- The changing nature of fraud and corruption within the university sector and/or technology.

Prevention strategies are proactive measures designed to prevent fraud and corruption insofar as practicable, and reduce the risk of incidents occurring. The University’s key prevention measures include:

| Strategy | Description |

| Culture: |

|

| Internal Controls: |

|

| Risk Assessments: |

|

| Awareness Training: |

|

| Pre-employee screening: |

|

| Supplier and Contractor Vetting: |

|

| Leave Management |

|

| Physical Asset Security |

|

The University has proactive systems in place aimed at detecting fraud and corruption as soon as possible after it has occurred.

All staff have a responsibly to prevent fraud and corruption. Almost half of identified fraudulent activities are reported by staff or external parties. To encourage all staff to report suspected cases of fraud, the University has implemented a formal reporting system through which staff can report suspected fraud and corruption.

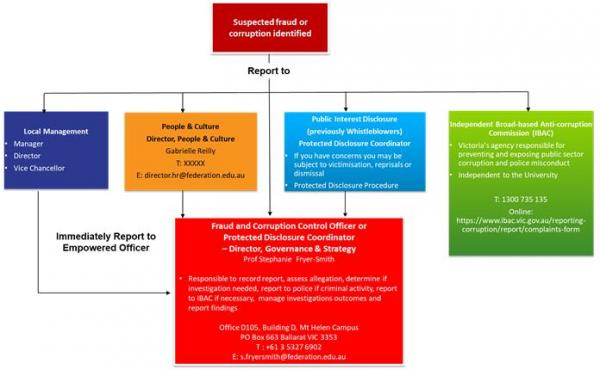

If you are aware or suspect fraud or corruption, you have the following reporting options:

- Your local management, including manager, director or Vice-Chancellor

- People and Culture

- Fraud and Corruption Control Officer

- Protected Disclosure Coordinator

- Independent Broad-based Anti-corruption Commission

Any reports of suspected fraud or corruption that are made to local management or People and Culture (whether to a supervisor, manager, director, deputy-vice chancellor or the vice-chancellor) are to be referred to the Fraud and Corruption Control Officer prior to any investigation of such allegations being undertaken. This is irrespective of whether the matter has also been reported to the police for action or not.

The Fraud and Corruption Control Officer is available for individuals to make reports or raise concerns, with the assurance of confidentiality. If these reports raise matters that could form the subject of a public interest disclosure, the Fraud and Corruption Control Officer will evolve the Protected Disclosures Procedure.

Staff wanting to make a public interest disclosure should refer to the Protected Disclosures Procedure (previously the Whistleblower Procedure) and may consult with the Protected Disclosure Coordinator or make their report direct to IBAC.

Ultimately, all formally reported claims will be managed by the independent Fraud and Corruption Control Officer. Below are the reporting details.

Reports of fraud, corruption or suspected fraud and corruption can be made as follows:

An individual who reports suspected fraud should provide as much information as possible, including details of any person they believe to be involved and the actions or activities they believe to be fraudulent, including how, when and where those actions or activities occurred. However, they should not investigate the matter themselves, as this may compromise a subsequent investigation.

It is noted that the University does not tolerate vexatious and frivolous reports and may initiate disciplinary proceedings where reports of this nature are found.

In addition to the above suspicious reporting channels, the University leverages the following systems:

| Strategy | Description |

| Internal Audit |

|

| External Audit: |

|

| Analysis of Management Accounting Reports: |

|

All reports of suspected fraud, corruption or improper conduct will be evaluated by the Fraud and Corruption Control Officer to establish whether a basis exists for further investigation. The following process will be followed:

In accordance with the Standing Direction 3.5 2018 under the Financial Management Act 1994 (Vic), the Fraud and Corruption Control Officer Accountable Officer will ensure all instances of fraud and corruption are recorded on a central register, including details such as:

- Date and time the incident was detected.

- Names of the parties involved.

- Names of witnesses or potential witnesses.

- How the incident came to the attention of the individual.

- The nature of the incident.

- The value of the loss, if any to the University.

- The action taken following discovery of the incident (if any).

The Fraud and Corruption Control Officer is responsible for coordinating and overseeing the University’s investigation response and will assess the incident to determine the appropriate manner of investigation. Although every suspected incident will be different, consideration will be given to, among other things:

- The nature and complexity of the alleged fraud or corruption incident.

- The seniority of the staff member and/or external parties suspected to be involved.

- The value of the alleged incident.

- The potential damage to the integrity or reputation of the University.

- The likely cost of taking action, including the cost of recovering financial losses or property.

- The likely benefit of taking action, including the deterrent value.

- Whether it is likely that the fraud is systemic or targeted, rather than an isolated or opportunistic incident.

- The likelihood that the fraud was committed by an external party with internal assistance collusion; and

- Any possible ongoing risks arising from the fraudulent or corrupt conduct, including any security implications.

Choosing An Investigator

Where the Fraud and Corruption Control Officer determines that an investigation is required, the investigation should be carried out by appropriately skilled, relevantly qualified and experienced personnel who are independent of the business unit which the alleged fraudulent or corrupt conduct occurred. The Fraud and Corruption Control Officer will appoint the investigator taking into account:

- Perceived required qualifications, experience and investigation skills.

- Transparency, confidentiality and independence to treat all persons fairly and consistent with the principles of procedural fairness.

- Physical, emotional or psychological issues/impacts.

An investigation may be conducted by personnel including Governance and Strategy, Internal Audit, Procurement, ITS, People and Culture and other appropriate and trained staff.

The investigators, whether internal or external, will be overseen by the Fraud and Corruption Control Officer, and will determine the appropriate form of investigation and ensure it is appropriately documented, including an investigation plan and investigation report, which will also be provided to the A&RMC.

An investigation will potentially involve the following investigative activities:

- Interviewing of relevant witnesses including obtaining statements, where appropriate including witnesses internal and external to the entity.

- Reviewing and collating documentary evidence.

- Forensic examination of computer systems/digital evidence.

- Examination of telephone records.

- Enquiries with banks and other financial institutions (subject to being able to obtain appropriate Court orders).

- Enquiries with other third parties.

- Data search and seizure.

- Search of the office or premise for documentary and physical evidence.

- Expert witness and specialist testimony.

- Tracing funds/assets/goods.

- Preparing briefs of evidence.

- Liaison with the police or other law enforcement or regulator agencies.

- Interviewing persons suspected of involvement in fraud and corruption.

- Report preparation.

Investigation Outcomes

On reaching a finding that there is evidence of fraud or corruption, the Fraud and Corruption Control Officer will make a recommendation (in consultation with the Vice Chancellor, Director or Manager and any other stakeholders as appropriate) as to what action should occur.

The following should be considered if the matter:

- Is determined to unlikely be a possible criminal offence, and not materially impact the University or its reputation, refer the matter to a divisional representative to resolve, fix the control weakness and/or proceed with administrative remedies.

- Relates to alleged criminal conduct by a department employee, or is a potentially serious or complex fraud offence, report the matter to Victoria Police and manage the University’s involvement in any subsequent criminal investigation.

- Meets the mandatory reporting threshold under the Independent Broad-based Anti-Corruption Commission Act 2011, or involves a senior officer of the University, or be significant in terms of value or complexity, refer the report to the Vice-Chancellor and the Chair of the A&RMC immediately, and report the matter to IBAC.

- Is ‘significant or systemic’ (an incident, or a pattern or recurrence of incidences, that a reasonable person would consider has a significant impact on the Agency or the State's reputation, financial position or financial management), in accordance with the Standing Direction 3.5 2018 under the Financial Management Act 1994 (Vic), as soon as is practicable, notify the Minister of Tertiary Education, the Department of Education, the A&RMC and the Auditor-General.

- Is considered prosecutable based on legal advice, refer the matter to the Legal Office for legal pursuit.

The thresholds for being “significant” to the University are:

- $1,000 for incidents involving purchasing and prepaid debit cards.

- $5,000 in money.

- $50,000 in other property.

When a matter has been referred to the relevant authority or law enforcement bodies, the University will provide assistance as requested throughout the investigation process.

Record Keeping

The investigator will maintain complete, accurate records of all investigations conducted into a fraud or corruption event. Given the private, sensitive or controversial nature of the records, the records should be held securely with access to them should be limited to those who “need-to-know’ having regard to privacy, confidentiality, legal professional privilege and the requirements of natural justice.

Investigation Privacy

Individuals involved in or who become aware of a theft, fraud, or corrupt conduct investigation, must keep the details and results of the investigation confidential, subject to the needs of the University, and/or the police during their investigation. Staff must not discuss or report any suspected or proven instance of theft, fraud or corrupt conduct to the media, except with the prior written approval of the Vice-Chancellor.

For all reported fraud or corruption incidents, an incident report must be prepared. The incident report should address:

- Investigation findings and recommendations.

- Whether any weaknesses in internal controls and systems have been identified and have or will be rectified. Where recommendations for controls improvement have been made, a Controls Improvement Plan will be developed and presented to the A&RMC, with the improvements implemented as soon as practicable.

- The status of any proceedings, investigations or disciplinary actions.

- What has been recovered, whether by way of money, stores, other property or insurance.

The Fraud and Corruption Control Officer will have responsibility to determine if an incident report is provided to the Office of the Vice-Chancellor, A&RMC, Council, relevant line manager or complainant. Determination will be based on impact to the University’s brand, seriousness of the actions, losses incurred and nature of the incident.

On an annual basis, the Fraud and Corruption Control Officer will report to the A&RMC on fraud and corruption, with a summary of the key fraud risks from the fraud and corruption risk assessment, a copy of the Fraud Incident Register, as well as a summary of all incident reports of suspected fraud and their status and outcomes and remedial actions taken.

Following an investigation, the University may pursue disciplinary proceedings with respect to all staff against whom violations of the Fraud and Corruption Control Policy or other relevant University policies have been established.

This may include dismissal in accordance with the University's disciplinary procedures and subject to the relevant enterprise agreements and workplace laws. Line management, People and Culture and Governance and Strategy will consult to determine the appropriate course of action.

Other actions may include possible termination of the relationship with the University or associate entities or civil action for the recovery of losses. Where it is determined that it is in the best interest of the University to undertake legal proceedings, action to recover any money or property lost through fraud will be vigorously pursued.

Confidential and independent counselling and other services are available to all staff of the University through the Employee Assistance Program EAP. EAP services are private and confidential. Staff can contact the EAP officer.

The University will maintain appropriate insurance cover against losses from fraud, including cyber fraud, after considering the required level of cover, inclusions/exclusions and deductibles, and level of risk. For losses, the Fraud and Corruption Control Officer will determine if recovery can be obtained via the insurance policy.

- Vice-Chancellor and President (as the Approval Authority) is responsible for monitoring the implementation, outcomes and scheduled review of this procedure.

- The Chief Financial Officer (as the Document Owner) is responsible for maintaining the content of this procedure as delegated by Approval Authority.

- Academic Governance Policy

- Corporate Governance Policy

- Operations Governance Policy

- Research and Research Training Policy

- Global Partners and Community Engagement Policy

- Fraud & Corruption Control Procedure

- Delegations of Authority Guideline

- Staff Code of Conduct

- Managing Conflicts of Interest Procedure

- Risk Management Framework Procedure

- Gifts, Benefits and Hospitality Procedure

- Finance Governance Procedural Manual - Procurement of Goods & Services, Corporate Purchasing Card, Travel, and Motor Vehicles

- Asset Management - Operations Manual

- Finance Governance Procedural Manual - Budget Forecasting, Management Reporting, Revenue Collection, and Debt Management Receivables

- Continuing and Fixed-Term Recruitment and Appointment Procedure

- Staff Consultancy Procedure

- Protected Disclosures Procedure

- Federation University Australia Union Collective Agreement.

This Procedure will be communicated throughout the University community in the form of:

- An Announcement Notice via FedNews website and on the ‘Recently Approved Documents’ page on the Policy Central Portal to alert the University-wide community of the approved Procedure.

- Notification to Council.

This Procedure will be implemented throughout the University via:

- An Announcement Notice via FedNews website and on the ‘Recently Approved Documents’ page on the Policy Central Portal to alert the University-wide community of the approved Procedure.

- Policy/Procedure Training Sessions.

- Staff Induction Sessions.

Prev

Prev Up

Up Next

Next